Needed a single system for lending industry which can

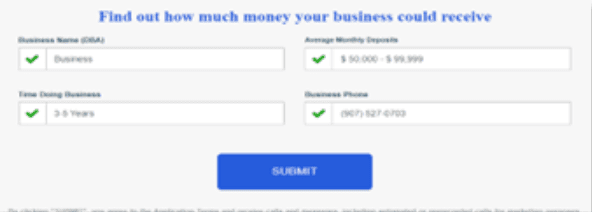

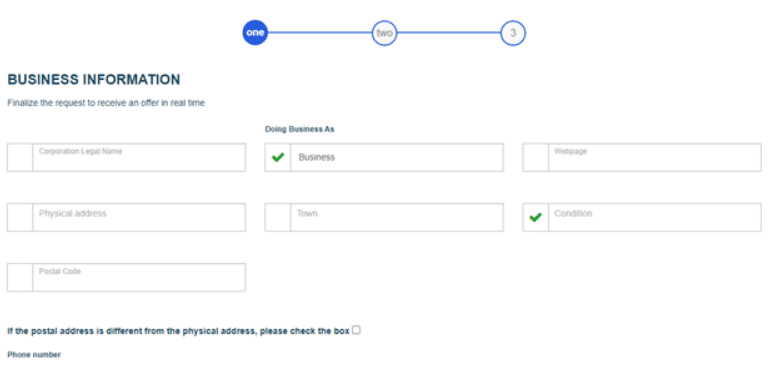

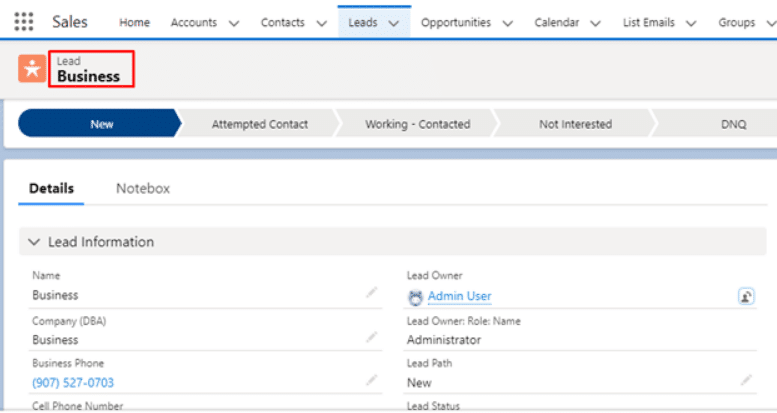

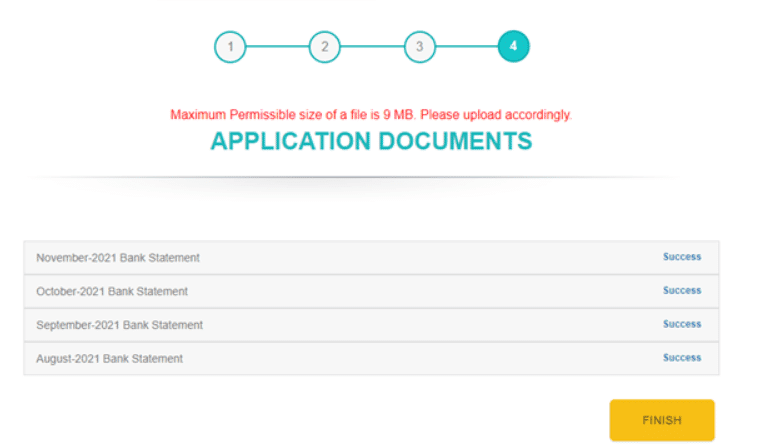

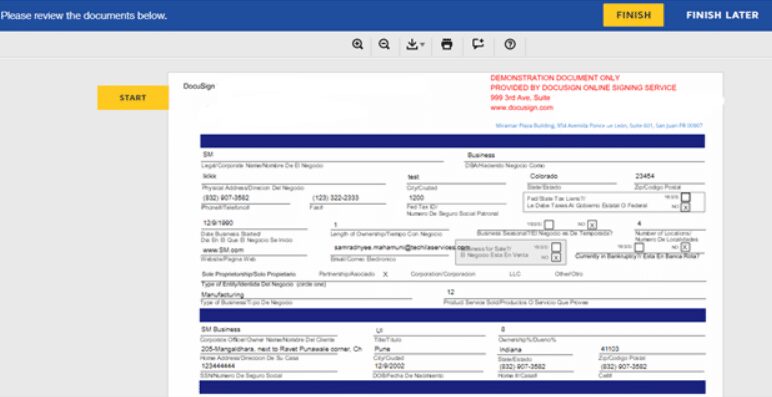

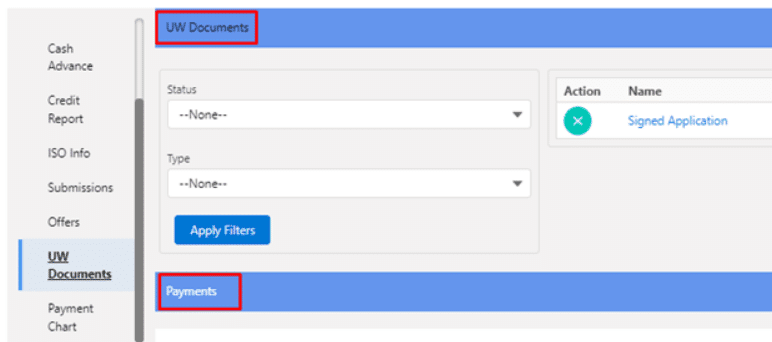

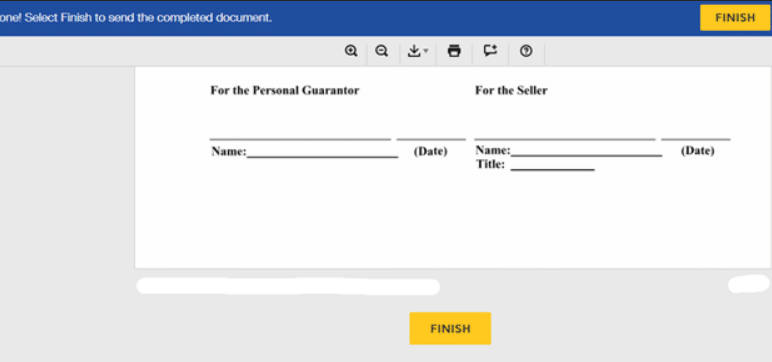

- track the prospect Merchant and collect all relevant information and documents

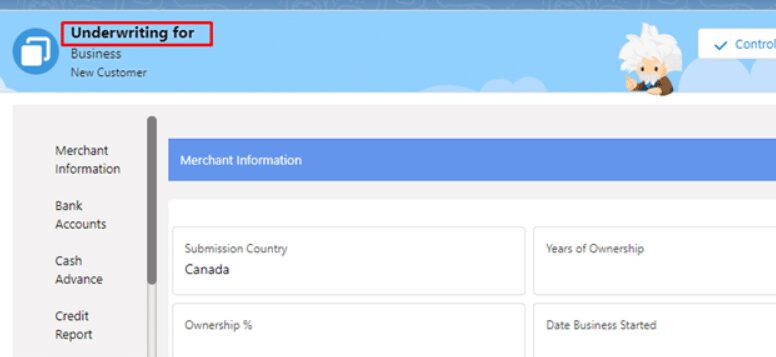

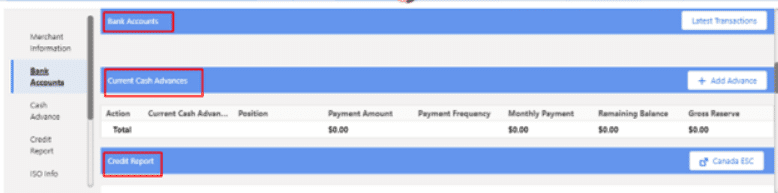

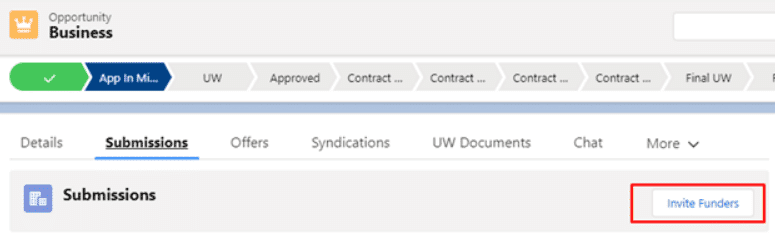

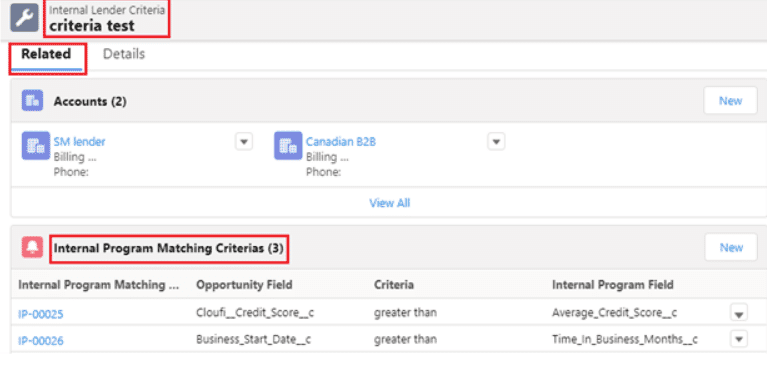

- screening of Merchants through Underwriting process

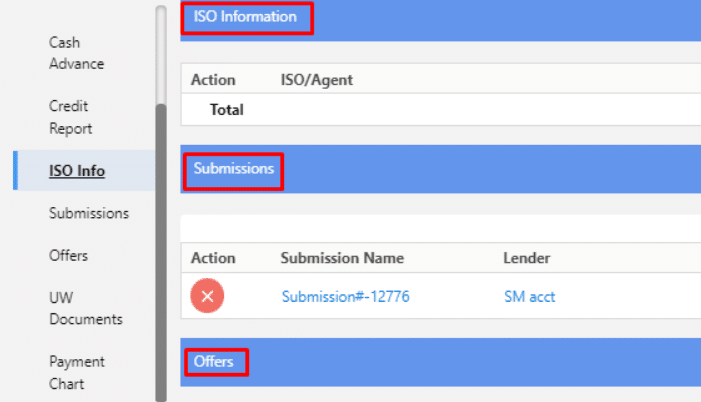

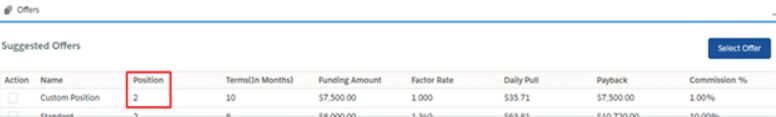

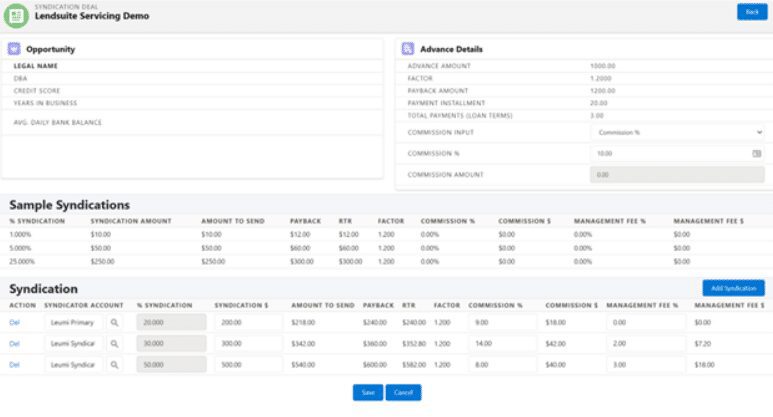

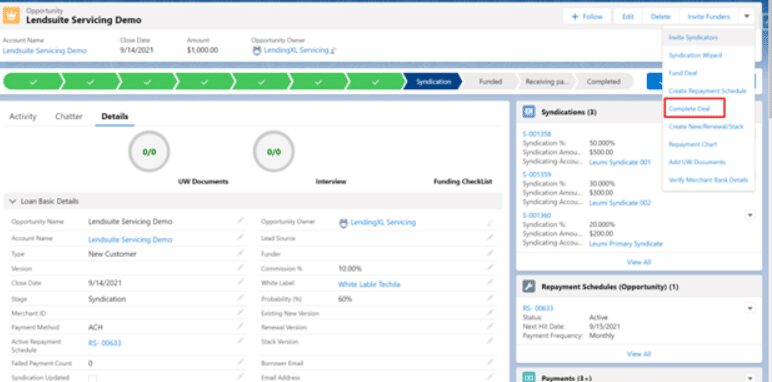

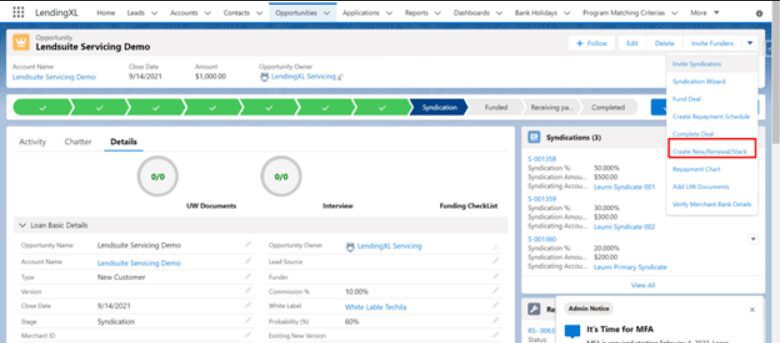

- collaborating with Syndicators for Funding for the deal

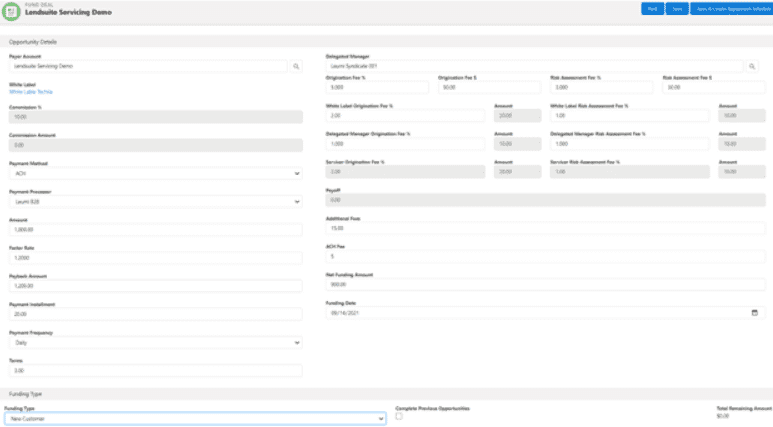

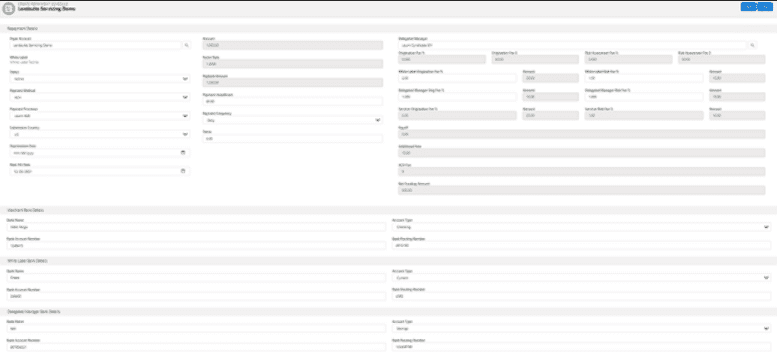

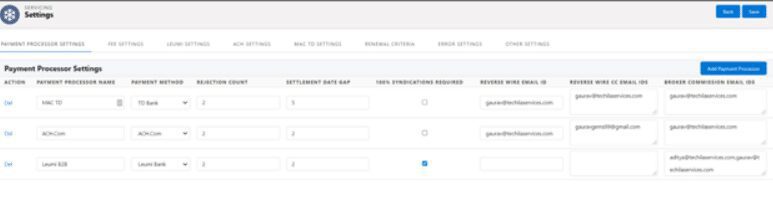

- Initiating funding process with Merchant as well as pay back to Syndicators

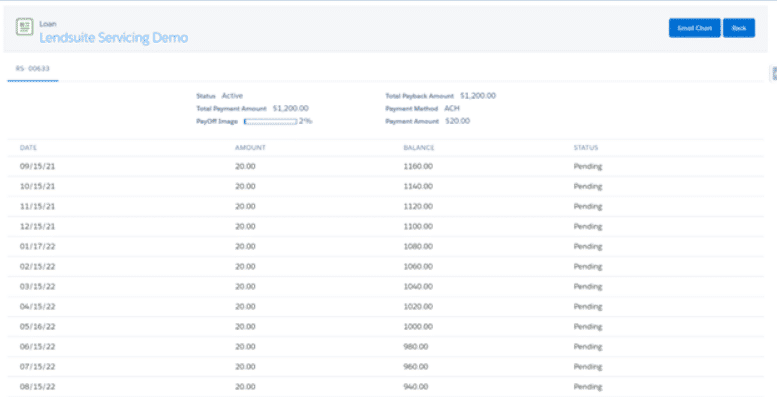

- Tracking of all the payments

- calculating all commissions and providing a Dashboard for the same.

+1 561 220 0044

+1 561 220 0044 +61 255 646464

+61 255 646464 +91 909 080

3080

+91 909 080

3080